“I should have bought that house five years ago.

It’s now gone up 20%. If only I knew.”

Property prices will always rise and fall but never in a neatly defined cyclical pattern. That’s why understanding property cycles is important if you buy and sell property – even if it’s only a few times in your life. For most people, it is the biggest single investment they will ever make, so getting it right and not losing money is very important.

If you understand property cycles well enough you can “buy in gloom and sell in boom” and maximise your investment return. Moreover, if you are trading up your primary place of residence, its capital gains tax, free. If you happen to buy at the wrong time as property prices begin to fall, take heart, if you hold the property long enough, history has shown that you will get your money back. In the current market where you are trading up, make sure you buy as soon as possible after you sell, as prices are rising by the minute – so act quickly.

With modern meteorological technology, the nightly weather presenter broadly gets it right more times than not these days. Our weather seasons, give us a broad indication of what the weather will be like – hot in summer & cold in winter – and so on. Moreover, better data can hone those broad weather predictions to include things such as extreme heat or cold, bushfires, blizzards, floods, and cyclones.

Our airlines and shipping industries rely on accurate up-to-the-minute forecasts for safe operations. Importantly, with weather forecasts available all day every day on a host of information platforms, there is never any excuse for not knowing what is ahead of us, in terms of weather. That, of course, allows us to plan our days, weeks and months.

Turning now to property cycles in Australia, and particularly Sydney, they are not as obvious and transparent as weather cycles, and no one has yet developed a daily “property cycle forecasting app” for our mobile phones. So where do we go and what are we looking for and how do we stay on top of things such as property cyclones and blizzards, but still be able to confidently buy and sell property at the right time?

I mentioned in a previous opinion piece that information is knowledge and knowledge is power and in the case of property, the power to make well-informed and successful decisions. That being the case, why don’t enough of us put in adequate time to inform ourselves about what property cycles are doing, when we come to dealing with property assets?

Where do we go (To get “information”)

In an age where we are all suffering from information overload, information around property is everywhere, if only we look for it. Quality newspapers such as The Australian and The Australian Financial Review have dedicated property sections most days.

Many research houses, such as BIS Oxford Economics (Australia), publish excellent material on property trends and cycles. The Reserve Bank of Australia also publishes their cyclical property market updates. As well, the NSW Property Council publishes regular opinion pieces around property trends.

If you prefer someone coming to you, in the comfort of your own home, tune in to Peter Switzer TV. “Switzer Daily.” Finally, keep your ear to the ground as to what’s happening locally.

On the flip side, the so-called group of Australia’s “26 leading economists” get it wrong and grossly wrong as many times as they get it right. My advice is, don’t listen to them! They wrongly predicted that property prices would fall by 30% in the 12 months from July last year. Oops!

What are we looking for (To turn the information to “knowledge”)

What we are looking for in terms of property trends and associated related data is the following thirteen “must-know items”- AKA – our knowledge list – to deal wisely and successfully in the property market. Importantly, several of the items on our knowledge list can, individually, significantly impact the property market either positively or negatively.

- Trends in historical property sales data – both bull and bear property markets can’t last forever. The trick is to predict when they will turn.

- Percentage movements in prices (+/-) over given periods – along with other data, will allow you to take an educated guess as to what the future might hold for prices.

- Property supply/demand trends – Is it a buyers or seller’s market and where is it heading?

- Mortgage interest rates – If rates are low, it is easy to borrow more. If rates are high, you will have to borrow less. These factors can and do directly impact property prices. Borrowers have been obtaining loans at a record 6 times their annual salary for 12 months now.

- Property affordability index – How much income it takes to buy an average priced house in Sydney at a particular point in time. Too much and first home buyers will be locked out of the market, and that’s not good long-term for property. Too little and it will force up property prices due to increased demand, as it has been doing for the last nine months.

- Building costs and labour supply- If building costs are too high and labour supply is in short demand, that will increase the cost of housing and vice versa – (if building costs are low and labour supply abundant).

- Unemployment rates – No job or fear of losing your job means no confidence to buy a property and borrow money.

- GDP – If GDP is too low, that is a tell-tale sign of a weakening economy which may see property prices drop.

- Inflation – The RBA’s target band is between 2% – 3%. Too much on either side and we may have problems.

- Percentage of first home buyers in the market – Generally, we need them at about 8%-10% otherwise the property market starts to become unbalanced.

- Migration rates – More migrants mean more jobs and they need somewhere to live which means more demand for housing which means higher prices provided there is not an oversupply.

- Confidence index – In any market, confidence is paramount and if there is a lack of confidence, people will sit on their hands and do nothing. That’s not good for the property market or indeed any market.

- Force majeure – (or “Acts of God”) like our current global COVID-19 pandemic. We need to know what impact these major events will have on our property market both (+/-).

How do we stay on top of things? (How do we use our “Power”?)

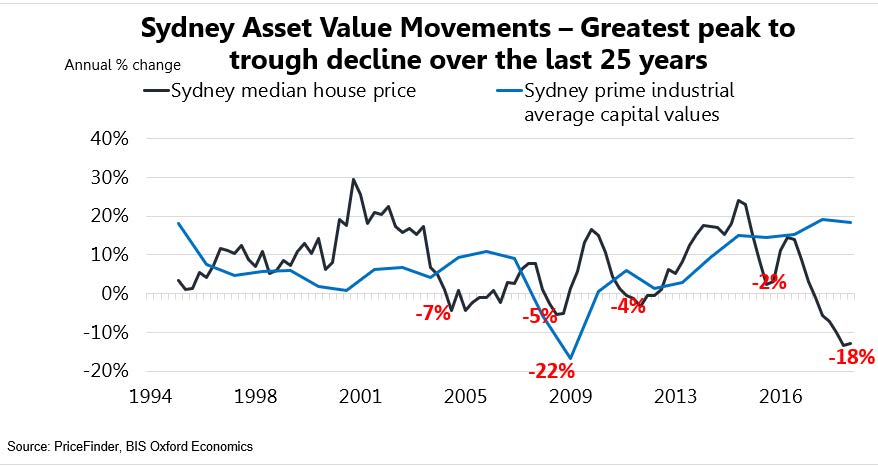

I have included the graph below on Sydney property prices for a few reasons.

a) So that we can use our “power” to analyse it as a learning tool for the future.

b) It is historical and so allows for a hindsight assessment.

c) It shows the hidden complexity of our property market.

d) It shows that guesswork alone will not cut it in making the right property decisions.

e) It is over a significant period of 25-years from 1994 to and including 2018.

f) It has two property classes, residential and industrial.

g) It highlights that different property classes can perform differently at one time.

h) The 25-year period in question witnessed:

- the single greatest 12-month reduction in residential property prices since WWII in 2018 of 18%.

- the single greatest 18-month reduction in industrial property prices since WWII to late 2009 of 22%.

- One of the largest ever increases in residential property prices of 29% in 2001.

- One of the strongest sustained rebounds in Industrial property prices ever from 2010- 2018 of 40% (that is from -20% to +20%).

The first question to ask is what happened in the following years?

- 2001 (residential property – up 29%)

- 2009 (industrial property – down 22%)

- 2018 (residential property – down 18%) and (industrial property – up 40% over 9 years)

The answers – in short form are as follows.

- In 2001, the start of which was less than four months after we hosted the Sydney 2000 Olympics and nine months prior to 9/11 in the US, we were on cloud nine. Confidence was high, unemployment was at its lowest in 20 years, normal building activity which had been delayed due to the games had recommenced in earnest. All of this occurred against a backdrop of subdued property prices in the 3-4 years prior to 2001. The result – a 29% increase in residential prices. It had to happen!

- In 2009 we were 12 months into the GFC – the worst financial crisis since the Great Depression. Confidence was low, money was tight and manufacturing was doing it tough – and surprise surprise – manufacturing groups buy and lease industrial property. The result – a 22% decrease in industrial property prices.

- In 2018 we were at the end of a period of reckless bank lending, resulting in the establishment of the Haynes Royal Commission. Too many people borrowed too much money and over-committed themselves and paid too much for overinflated property which subsequently fell in value. On the flip side, manufacturing was doing well and needing good property out of which to operate and so industrial property prices increased by a staggering 40% over 9 years to 2018.

Apologies that (1) the above graph does not have written, the year 2018, on its horizontal axis and (2) the words “last 25 years” in the document heading should be substituted for “period from 1994-2018 inclusive”.

My view on residential property values in Sydney over the next 12 months using my “Information – Knowledge – Power” model.

Information

- Residential property values across Australia are currently rising on average by $1.50 a minute. That’s $1.00 every 40 seconds.

- The annual property growth rate in Sydney in 2021 is the highest in three decades – since 1988, our bicentennial year – at 26%.

- Across Sydney’s northern beaches the annualised growth rate has been a whopping 38.6%. The highest ever recorded!

- With the current COVID lockdown, there is a very limited supply of property on the market and so property that comes onto the market is sold-almost overnight at inflated prices.

- In Kensington last month, there were two units and in Randwick three units available for sale. All were sold at inflated prices. Two of them effectively sold before they were listed.

- Kensington and Randwick are awash with blocks of units and in normal market conditions there would be 30 to 50 individual units for sale at any one time.

- Due to COVID, we Australians have saved an ADDITIONAL $210 billion over the past 12 months. I estimate that about 25% of that will be spent on property purchases/renovations.

Knowledge

- The bull run is likely to continue

- Property prices will likely continue their upward movement over the next 12 months.

- It will still likely be a sellers’ market.

- Mortgage interest rate will likely continue to be at historic lows.

- Property affordability will become harder for first home buyers for mid-range property purchases as prices keep rising.

- Building costs will increase due to COVID induced material shortages particularly timber which has gone up over 30% in 12 months.

- With COVID freedoms predicted by mid-October 2021 unemployment will quickly fall.

- GDP will be flat, if not negative, for the December quarter but will rise sharply in the March and June quarters in 2022.

- Inflation will likely tick up to about 2%, or a bit more, by June 2022.

- First home buyer participation will likely reduce to about 5% – 7%.

- Net migration rates will remain negative for all of 2022.

- Confidence will be high both from big businesses and individuals.

- Permanent work change habits will see many more people work from home permanently or more regularly. That will increase the demand for bigger and more functional housing with designated work/living areas.

Power – my predictions

- Property prices in Sydney will rise by an average of 10%-20% from September 2021 to December 2022.

- Demand will continue to outstrip supply.

- Money will continue to be historically very cheap.

- Larger units will become more appealing than smaller ones.

- Home renovations will experience a mini-boom for those that can’t afford to move or for those who do not want to move.

Some facts

- Property price increases over the past 12 months have defied all logic and expectations so, any analysis along historical lines is pointless. We are in unchartered waters – in my view – and so very specific analysis and attention is needed.

- Property in Sydney has been the most stable and best-performing asset class of any other since WWII over a 75-year period.

- No matter if you buy property at the peak of any cycle (2001-see above graph) if you hold it long enough you will regain your notional loss (2015-see above graph again). NB- the longest period recorded to regain a top of the cycle loss – 15 years.

- If you buy at the top of the cycle you might need to hold onto your property for several cycles before you get your money back.

- If you buy at the bottom of a cycle and sell at the top of the next cycle, see the above graph you can make up to a 20% gain as occurred from 2009-2015.

- The current growth in property prices is unprecedented and cannot be sustained for more than about 18 months, after which I predict a period of flat or slightly negative growth for about three years, on information available to me at present.

- Although already mentioned on a few occasions in this opinion piece, here are some more eye-watering statistics about the Sydney property market over the past 12 months.

- Sydney house prices have increased by an average of 31 per cent. The highest ever recorded for a 12-month period.

- The median Sydney house price has increased by $308K to $1.3M or by $843/day.

- A $3M property purchase is now becoming the new $1M property purchase.

- Housing affordability is getting worse particularly with mortgage interest rate at sub-2%pa.

- The former housing commission suburb of Mt Druitt recorded its highest sale recently – a three-bedroom house sold for $123K above reserve for $1.17M

- 35 additional suburbs including traditional working-class suburbs such as Lidcombe, Bankstown and Condell Park are now suburbs with average house prices over $1million.

- My property “crystal ball” may need polishing in another 12- 15 months!

John (JT) Thomas

This article is provided by John (JT) Thomas, a 45-year veteran of the financial services industry and since 1987 a specialist in commercial mortgage funds. Considered by many to be the grandfather of the modern commercial mortgage fund sector, JT helped establish and then manage – for 17 years – what became the largest and most successful commercial mortgage fund in Australia the Howard Mortgage Fund. At Howard’s, JT lent over $7bn in commercial loans to a variety of commercial borrowers for a variety of reasons including construction and development purposes.

JT has been proudly involved with Princeton Mortgages for eight years and sits on both the Princeton Credit Committee and the Princeton Compliance Committee as well as being an advisor to the Princeton Board.

Other Articles

Read the latest in thought leadership from Princeton.

Counter Intuitive Thinking

Here’s the thing I’ve long argued: The solutions to our problems are often counter-intuitive. The right course of action can be the exact opposite of what we initially thought. The best answer or explanation can challenge our gut instinct and require us to embrace that which does not come naturally and/or defies our [...]

Money makes the world go around

Money makes the world go around, or so the song says. The world as we know it would not function without money. Money is an essential human creation and everyone uses it. Money has a powerful influence on our lives and we have an emotional connection to it. Money keeps us awake at [...]

Personal Debt

With Australians spending an estimated $65billion on Christmas shopping in December 2023, some consumers were not able to pay off their credit card and or buy now pay later finance when they become due in late January or February 2024. Some have sadly declared bankruptcy, which is the theme of this months’ Viewpoint. [...]

Design Thinking

Recently, I heard someone say: “You must fail quickly and cheaply in order to learn and succeed”. These words were uttered by an expert in design thinking when talking about the need to experiment with possible solutions to problems. Design thinking is an iterative process to finding solutions and requires a deep empathy for [...]

How being watched by others changes your behaviour

My identical twin brother’s son-in-law is a television camera operator and has years of experience filming people and events from all over the world. From videotaping athletes at the Sochi Winter Paralympics to recording Queen Elizabeth II at Buckingham Palace, he has experienced first-hand what most of us intuitively know – people behave [...]

Performance Measure pitfalls

Distinguished economists, statisticians and mathematicians often have their name associated with some economic theory, concept or tool. Some examples include Giffen goods, the Nash equilibrium, the Phillips curve and the Gini coefficient. Today, I would like to introduce you to another economic concept - Goodhart’s law. This “law” testifies that social or economic performance [...]